Investment strategy and asset allocation

The investment strategy is to have very broad diversification of different assets like stocks, forest, real estate, government bonds, corporate bonds and materials like gold.

Rahapuutarha maintains fixed asset allocation percentages between these different assets. If one asset class is performing very well, it's weight in portfolio is increasing and thus Rahapuutarha will make new purchases to asset classes doing worse. In this way we always buy assets with low price and sell them with high price.

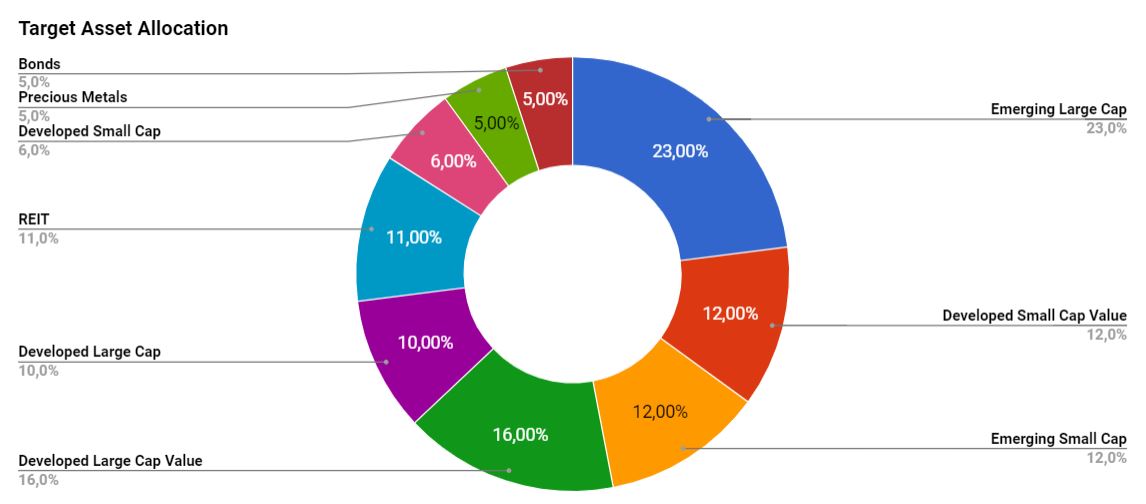

Example asset allocation between different asset classes, displaying only exchange tradable liquid assets. In the real portfolio these are still splitted into smaller segments.

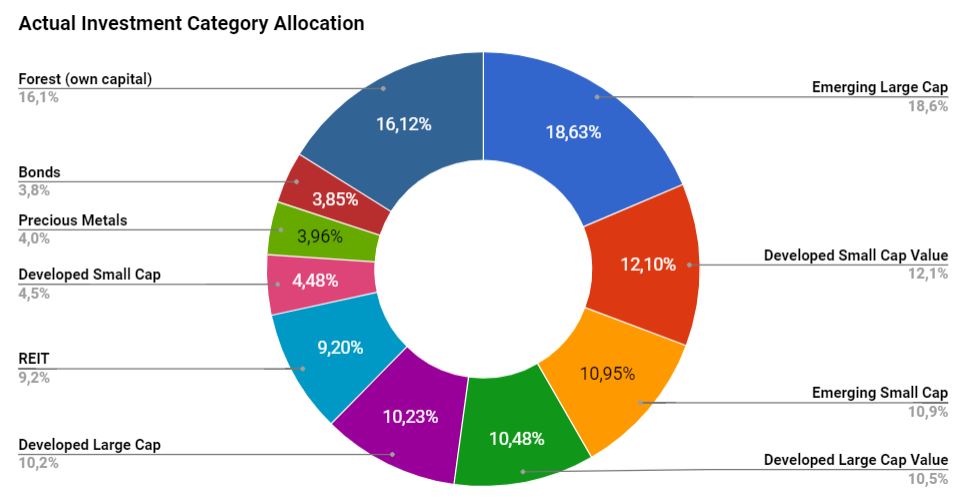

Current actual asset allocation between asset classes. For forest the picture shows only own capital allocated, while the position is significantly leveraged and in the beginning it was purchased with 100% loan.

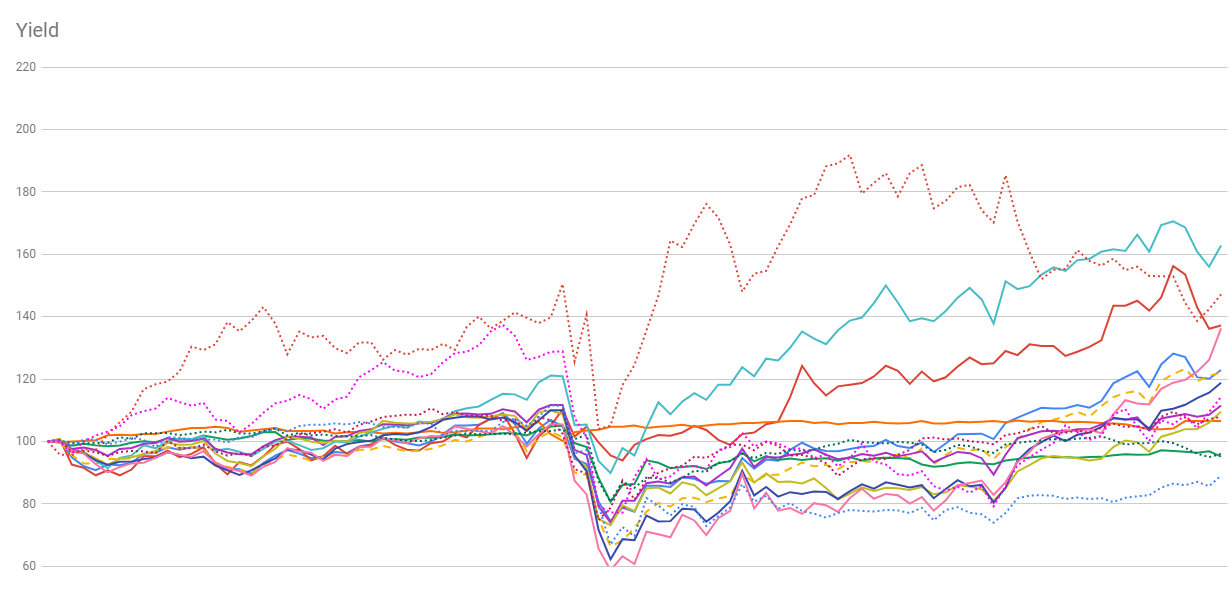

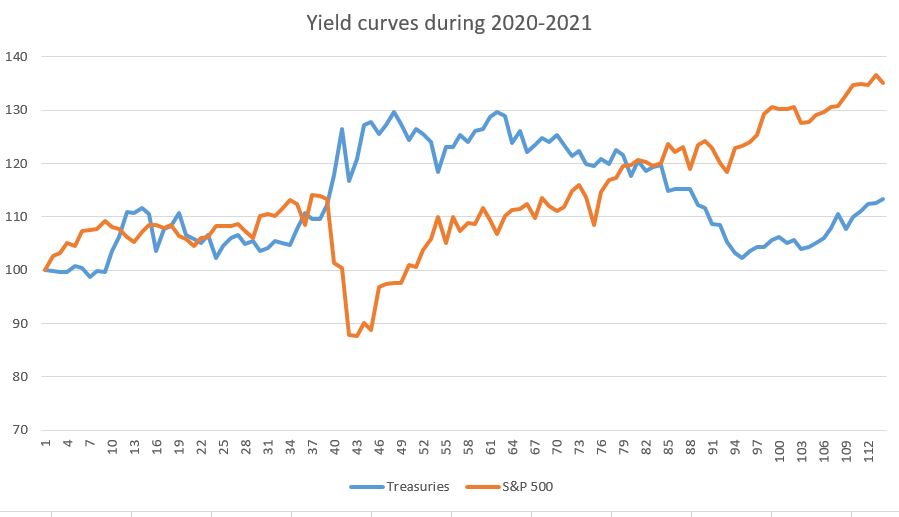

The Corona crisis, shows well the idea of the portfolio. When assets behave in different ways, active rebalancing can create excess returns while still lowering the total risk of the portfolio. As an example graph below shows performance of several different stock market indices during the last two years.

Since Rahapuutarha strategy has required us to rebalance between different asset classes in the portfolio, we were investing lot into sectors not doing well right after the crisis - making largest losses. For example small stocks with value characteristics. These stocks have since outperformed Nasdaq, resulting over 80% yields.

Why forest

Forest grows no matter of the financial turmoil in stock markets. Demand for toilet paper is rather fixed and today's world has a constant need for cardboard boxes. With sustainable and modern forestry strategies also the yield from forest investments can be surprisingly high. Forest is the backbone of the fund and main alternative investment.

Forest investments are typically not well accessible, at least with small risk, for starting private investors. But through Rahapuutarha, you can share the risks of one plot between multiple investors. Also unlike most “forest funds” Rahapuutarha does not suboptimize and only aim for high profits from forests. We plan the forest management in a way which will make the most out of the whole portfolio. This sometimes means cuts before planned time or letting the forest grow longer than in “optimal” forestry management.

Why gold

Gold has long been recognized as a valuable hedge during periods of volatility. Historically, its prices have tended to rise when central banks engage in extensive monetary printing or when general market conditions are turbulent. As such, gold offers a unique opportunity to diverge from overall market trends, providing a defensive component within a portfolio.

While cryptocurrencies are also often perceived as potential alternatives in times of market turmoil, it's important to note that they exhibit a substantial correlation with stock markets and especially with Nasdaq. In contrast, gold maintains a negative correlation, further distinguishing its resilience as a safe haven asset. This key distinction underscores the enduring strength and reliability of gold as a protective element within our investment strategy.

At Rahapuutarha, we recognize the distinctive qualities of gold, and while we do not directly invest in the material itself, we leverage alternative methods to achieve exposure to this defensive asset. This approach ensures that our investment strategy remains rooted in maximizing long-term growth and value creation, while mitigating undue risks associated with highly correlated assets like cryptocurrencies.

Why bonds

Just like gold, bonds present an opportunity for diversification within your portfolio, leading to enhanced overall returns while simultaneously reducing risk. This phenomenon is clearly illustrated in the graph below, showcasing the inverse relationship between long-term bond returns and stock returns during periods of recession.

It is important to note that central banks have intervened significantly in bond markets, artificially driving down borrowing costs. In response, Rahapuutarha has adjusted our bond positions accordingly, placing emphasis on areas where market mechanisms continue to operate effectively. This proactive approach allows us to capture the full potential of bond investments while navigating the evolving landscape of monetary interventions.

With Rahapuutarha's automatic balancing rules, our strategy is designed to capitalize on market events such as the Covid-19 pandemic or financial crises. During these times, we strategically sell long-term bonds and reallocate funds to take advantage of discounted stocks. This approach not only mitigates portfolio volatility but also generates additional returns, effectively capturing the benefits of market fluctuations.

By adhering to disciplined rebalancing practices and adapting to the changing dynamics of the bond market, our investment approach ensures that your portfolio remains well-positioned to weather challenging market conditions while maximizing long-term growth and stability.